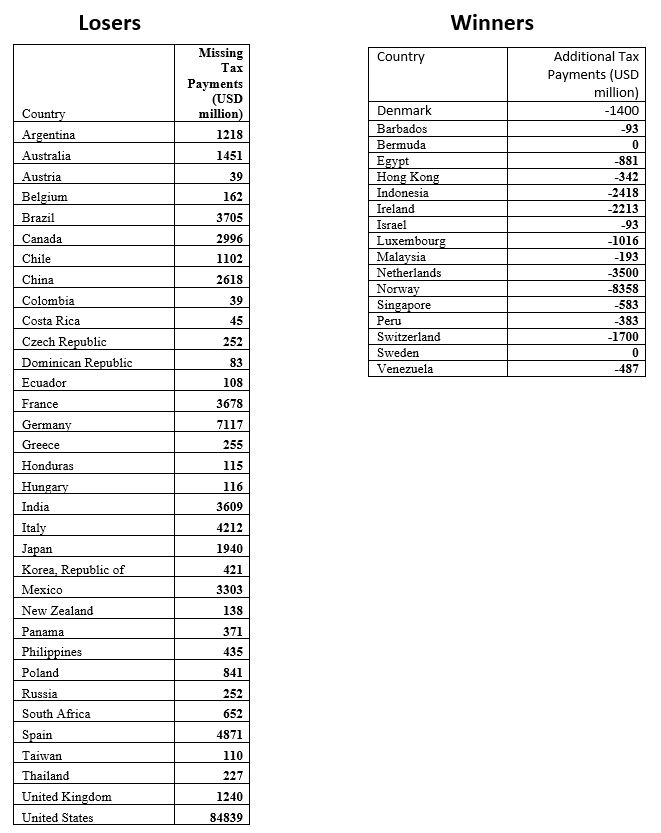

Table of missing tax payments

The underlying missing tax payment figures are estimates based on the profit which was shifted out of each country by US corporations without being taxed. The figures come from the annex of a research paper written by Cobham and Loretz titled “Measuring Misalignment”. The amount (in millions) is based on how much tax US based corporations avoided. The total global corporate tax avoidance figures, which includes multinational based in all the other countries of the world, will of course be much higher.

Where the “Missing Tax Payments” figure is positive this is the total amount of tax which the government missed collecting because corporations moved some of their profits to a different country to avoid this tax. Where the number is negative this represents an overpaying of tax because profits have been shifted into that country by corporations, even though the profits weren’t necessarily made there. A tax ‘overpayment’ usually correlates with low or no national corporate tax rate. For example amongst biggest positive figures in table two are Switzerland, the Netherlands, Luxembourg and Ireland: all notorious tax havens.