Investigation reveals how the big tax dodgers scam us! Stop secrecy, invest in fighting tax avoidance

EPSU statement

A group of investigative journalists revealed yesterday how 1000s of rich individuals are using tax havens to avoid paying their fair share of taxes http://www.guardian.co.uk/uk/2013/apr/03/offshore-secrets-offshore-tax-haven.

With an estimated 32 Trillion dollars stashed away in accounts in tax havens, it brings further evidence that if multinationals, investment funds and wealthy individuals would pay their taxes enough money would be available to fund social care, healthcare, education and research and reduce poverty.

Rather than austerity we need real actions to clamp down on the culture of tax avoidance based on secrecy, exploitation of legal tax loopholes as well as criminal activities. The fact that some of these tax dodgers are elected politicians or government officials is nothing less but a threat on democracy.

EPSU Deputy General Secretary Jan Willem Goudriaan "This excellent work shows that secretive wealth accumulation is part of the problem sapping resources society needs. It underlines that tax administrations should be strengthened and properly funded with much stronger legal means to act. Yet, our recent research shows that most EU governments are doing exactly the opposite by axing jobs in tax services."

EPSU pays tribute to the work of the journalists who are breaking the wall of secrecy, tax dodgers best friend and a key obstacle to cross-border cooperation between tax administrations.

Mr Goudriaan adds: "We need a stronger and bolder EC action plan on tax fraud than on the table. It needs more bite, stronger non-compliance sanctions and should not distinguish between tax havens in or outside the EU. Companies that use cohorts of lawyers and consultants to avoid paying taxes must be forced to disclose tax arrangements. Those who don t must be known and barred from state aids and public contracts. We call for a European public blacklist of tax dodgers on the basis of common criteria that go beyond those already available and that have proven ineffective."

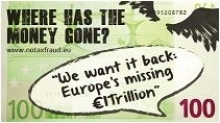

EPSU's campaign "The missing €1 trillion in Europe: we want it back", launched last November, is part of its broader campaign against austerity and for tax justice.

Read full EPSU statement here (pdf):