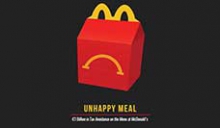

Unhappy Meal: Unions expose McDonald's tax practices

In a joint report from unions and the NGO War on Want they show that McDonald's has avoided over 1 billion Euros between 2009 and 2013.

PSI General Secretary Rosa Pavanelli says that European governments have no excuse for painful austerity measures while multinational companies are allowed to avoid this amount of taxes.

“Who can be surprised that corporate profits and inequality grow while unemployment rises and public services are cut, when we now know that companies like McDonald’s shift their profits out of the countries that make them wealthy. Everyone benefits when companies pay tax where they make the profits,” Pavanelli said.

PSI has been campaigning against multinational corporations shifting their profit to tax havens. PSI attended the G20 summit in Brisbane to take the message to the world's leaders that universal public health can be afforded if we ensure corporations pay their fair share.

PSI and TUAC have been lobbying the OECD to ensure that its review of these practices makes a real difference.

For more information:

- See PSI's Press Release

- See the report Unhappy Meal

- See PSI's work on Public Funding and Tax Justice

- See the EPSU website No Tax Fraud

- See EPSU's Press Release